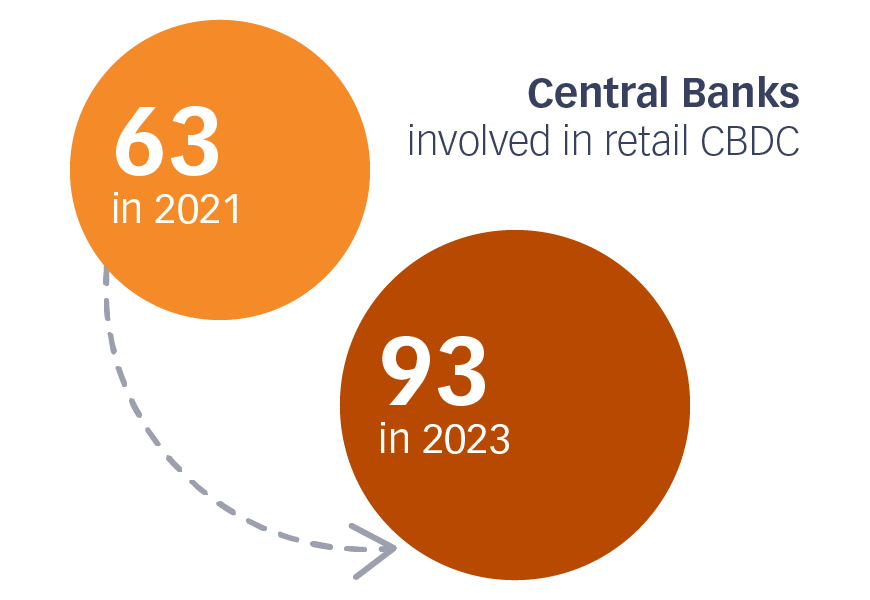

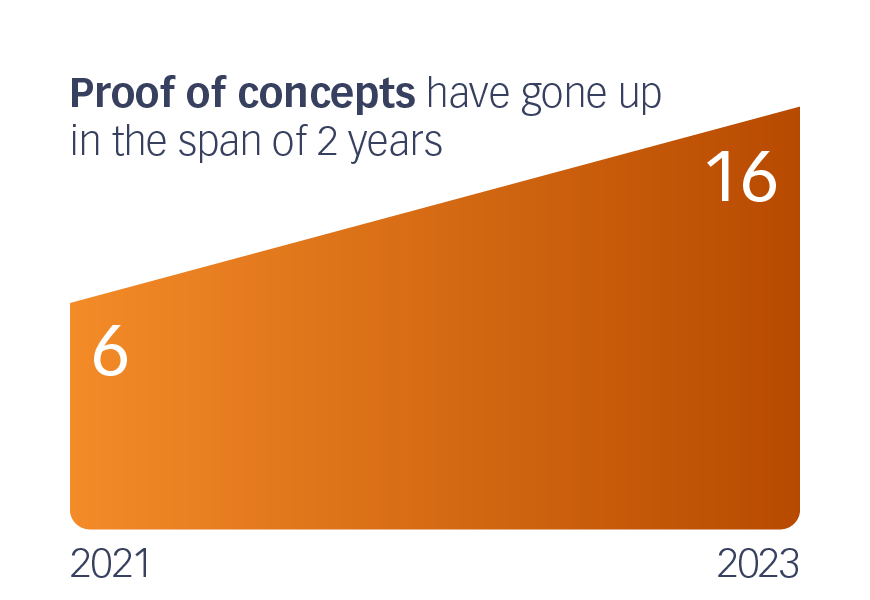

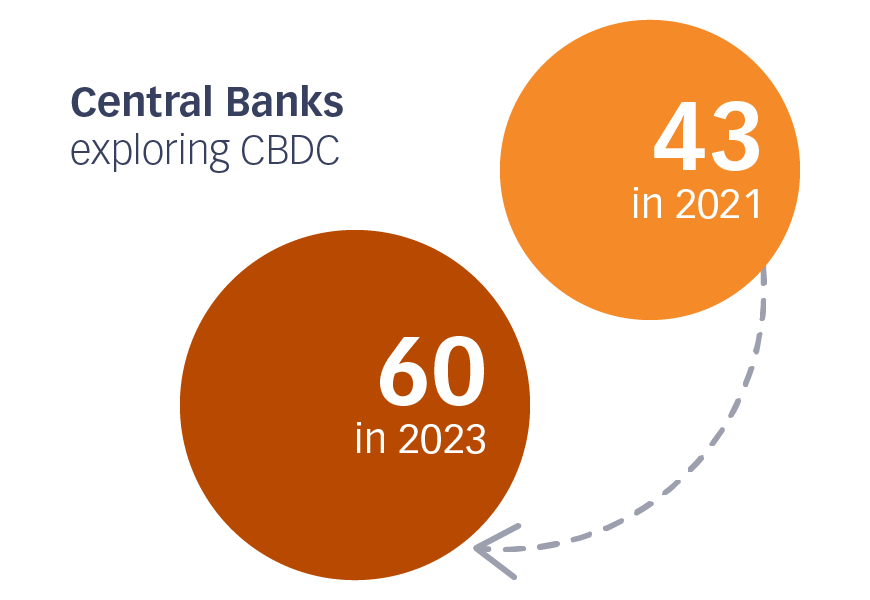

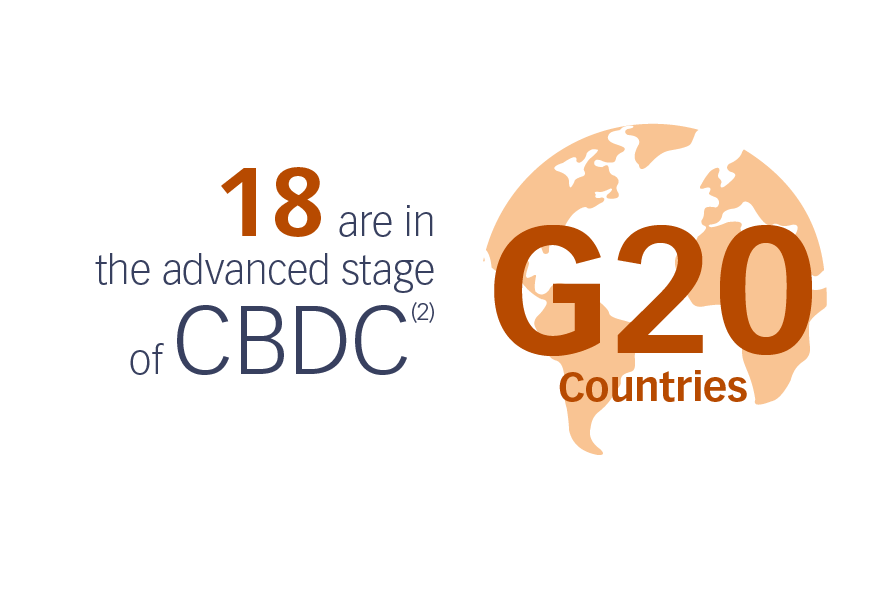

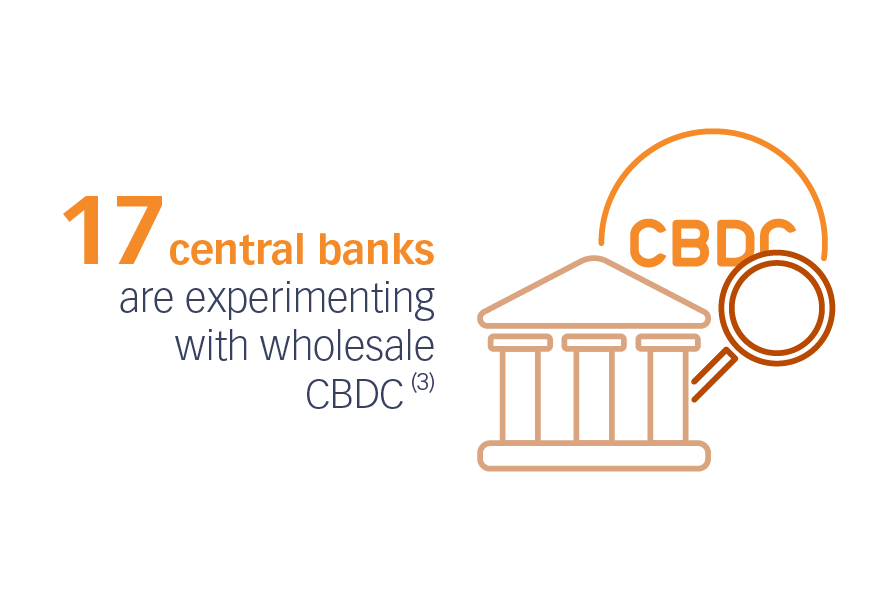

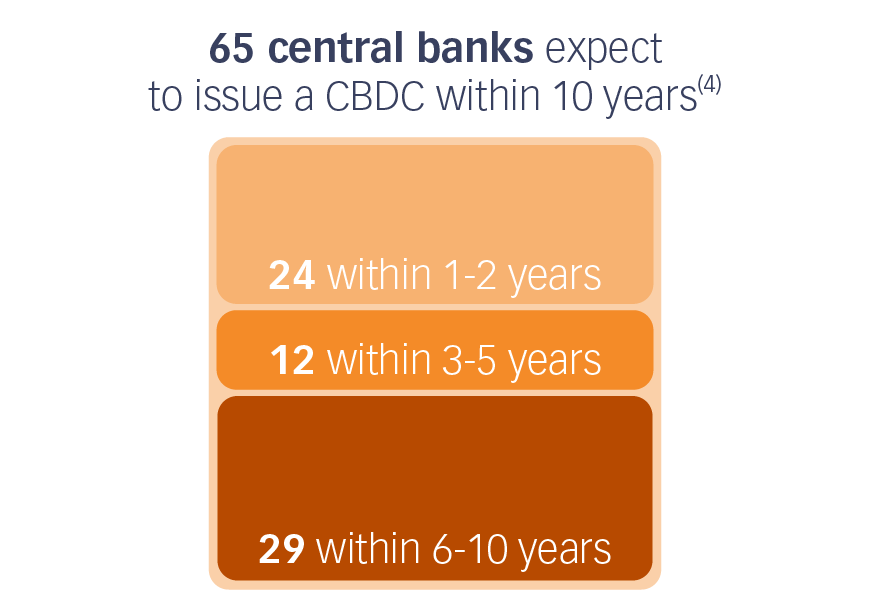

In recent years, we witnessed central banks becoming more and more interested in CBDC to revolutionize their payment ecosystem and effectively satisfy the increasing demand for electronic payments. But where do they stand today, and where in the world are we at with CBDC?

Let’s look at the latest scoop.

Launched Projects

References:

You May Also Like

A Visionary Payments System for Tomorrow

The payment landscape is undergoing a profound transformation with the advent of the ISO 20022 migration, reshaping the banking sector. As central banks grapple with this monumental shift, they are exploring various strategies to adapt. But how did this transformation begin? And what is the ultimate solution for banks to adopt? Dive into our article to uncover the answers.

5 Challenges Cloud-native Infrastructure Can Help You Overcome

As the global landscape rapidly embraces automation and cutting-edge technologies, cloud-native infrastructure emerges as the optimal solution for organizations aiming to effortlessly scale and optimize their operations. But what are the barriers that cloud-native infrastructure has completely dismantled? Discover them by diving into this article!

The Riveting Financial Trends Set to Dominate 2024

As the reverberating echoes of groundbreaking innovation draw near, listen closely as we delve into the financial trends of 2024.