February 16, 2022

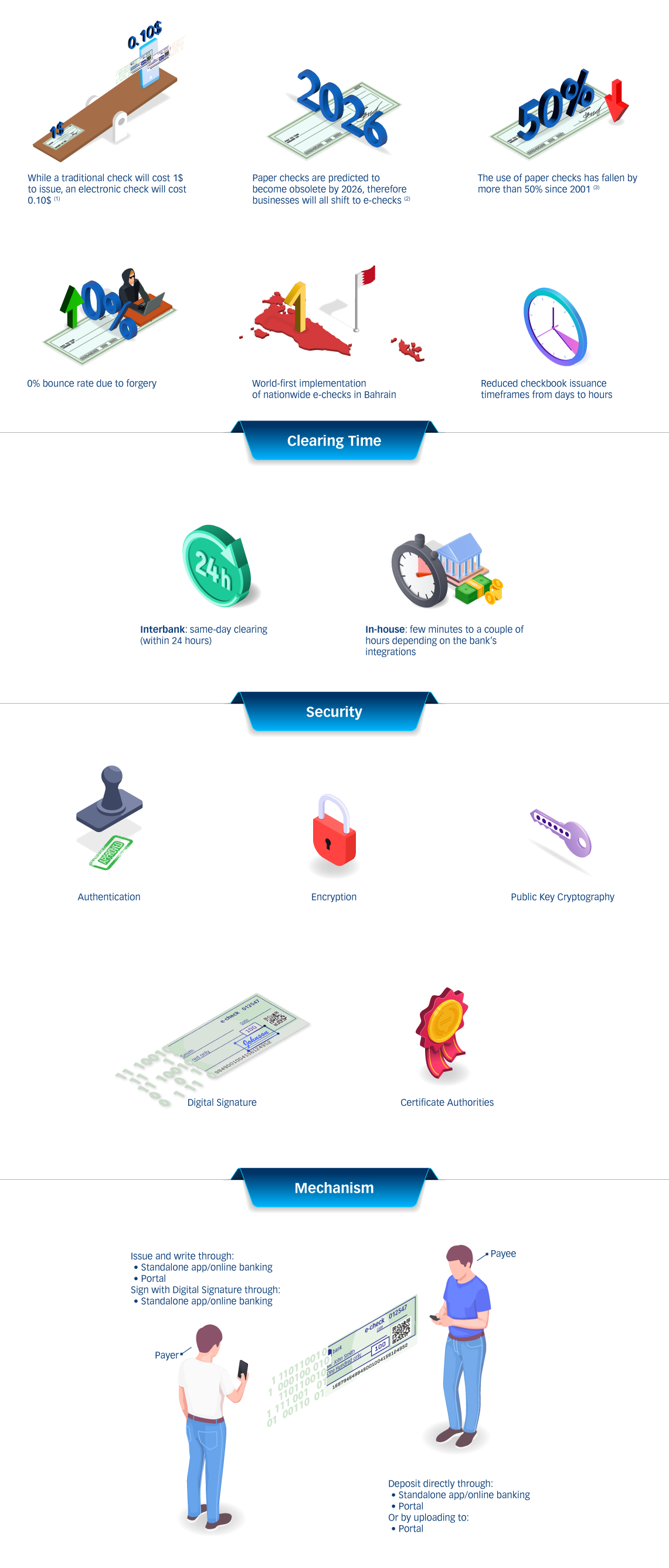

Why Invest in Electronic Checks?

The hassles, costs and risks associated with traditional physical checks are today becoming outdated. Financial institutions are shifting towards an entirely digitized process for checks to reap massive benefits on a nationwide scale. For this purpose, ProgressSoft’s Electronic Check Issuance solution was created to mimic the traditional paper check and replace it with a fully electronic version. Here’s why your institution should invest in our solution:

References: