August 10, 2025

Automating Check Processing: A Modern Imperative for Banks

Digital automation has radically reshaped payment services, thanks to the increased usage of smartphones and the internet. Billions of digital payments are processed globally each day, significantly reducing the reliance on traditional payment methods including cash and checks.

Check processing, in particular, presents operational challenges in terms of the cost and resources required to handle checks from issuance to clearance. These overheads are substantial for banks, businesses and customers.

Some key factors include:

- Checkbooks require paper, printing and distribution, all of which incur significant costs

- Checks require manual handling including data entry, sorting and verification

- A considerable workforce is needed to complete processing, verify and reconcile check transactions in a timely manner

- As check clearing is time-bound, the risk of operational lapses, especially in signature verification, is higher

- Check fraud necessitates monitoring systems and insurance

Despite the exponential rise in digital payments, checks are still used in many countries due to a combination of IT infrastructure, regulatory frameworks, business practices, behavioral and specific use cases. Even by conservative estimates, there are approximately 5–7 billion check payments made worldwide each year. Reasons for the continued use of checks include:

- In certain regions, business and banking systems are still built around checks, making transitions difficult

- Some legal systems and business contracts rely on checks for court settlements, tax payments and real estate transactions due to audit, validation and tracking needs

- In countries where digital payment infrastructure is still developing, checks remain a trusted alternative

- Post-dated checks act as credit instruments in specific markets

- Checks are perceived as a cost-effective payment method by both payer and payee

- Lastly, cultural and behavioral resistance, particularly among older generations and traditional businesses, remains a strong deterrent to adopting digital payments. In fact, there have been instances where efforts to phase out checks were halted due to public opposition

Given the above, it's clear that check processing will continue in the near to medium term. Therefore, banks must automate this process to minimize operational overhead and risk.

Four Things Every Bank Should Consider

Check processing may be declining, but it’s far from gone, especially in regions where legal, cultural and infrastructural factors still favor its use. So how can banks keep up with demand while reducing risk and operational overhead?

Here are four critical aspects banks need to automate check processing and future-proof their operations:

1. Check Data Extraction

While Magnetic Ink Character Recognition (MICR) data can be digitally read from the check image, many critical data fields still require manual entry, which is time-consuming and error prone. An ideal solution would use Optical Character Recognition (OCR) and Intelligent Character Recognition (ICR) tools to extract bilingual handwritten and typewritten data from checks.

To improve accuracy and support fraud detection, advanced systems can incorporate template classification models that recognize the layout and design of the check. This allows precise extraction of fields like the payee name, amount and date based on the check’s structure. Such models are particularly useful in multilingual contexts and can also flag irregular layouts or modified templates that may indicate fraudulent activity.

This approach applies to inward, outward and on-us checks, enabling banks to handle high volumes more efficiently while reducing manual processing errors.

2. Check Data Technical Validation

Once data is extracted, validation can be performed using AI to detect inconsistencies in the check data, such as:

- Date standardization and validation

- Automatic correction of obvious spelling errors

- Matching of courtesy and legal amounts

- MICR data validation

- Name matching against the account holder database

This significantly improves accuracy and consistency across all check types. Validation engines that incorporate AI can also perform real-time anomaly detection by comparing check fields against known patterns and historical behavior.

For example, if a payee name does not match any record in the customer’s profile, or if the written and numeric amounts differ, the system flags the check for review. These engines can also apply business rules, such as transaction limits or exception handling protocols, to enable automated decision-making.

3. Signature Extraction

Automatically extracting signatures from checks can be difficult due to overlaps with printed text, lines or noise. AI models can help isolate signatures by filtering out background noise and interference.

Signature extraction models trained on real-world data can differentiate between signature strokes and surrounding noise. This is critical for cases where the signature crosses pre-printed lines or overlaps with the MICR band. More sophisticated systems use context-aware segmentation to isolate and enhance the signature region before analysis.

4. Signature Verification

- Signature quality can vary. Scanning resolution may be low, multiple signatures may be stored on the same card, and individuals’ signing habits can change over time due to age or reduced handwriting frequency. Systems must allow for the collection and learning of high-quality reference signatures over time.

- Automatic area adjustment is necessary, as signatures may not always appear within designated zones on the check.

- A universal threshold does not suit all cases. Account-based and signatory-specific controls can help fine-tune verification, particularly for printed signatures, stylized names or signatures with high variability.

- AI can also be used to detect signature locations across various document types. It can also identify alterations and verify UV patterns.

- Machine learning algorithms, including deep neural networks, can be used to enhance signature regions, analyze patterns and classify them for higher verification accuracy. These models are developed through extensive research and testing.

- Systems can also automate amount verification by applying structured business rules, authorization matrices and version controls. This enables true straight-through processing (STP) for checks.

Modern verification engines use deep learning to compare extracted signatures with multiple stored references, accounting for natural variability over time. These systems may use dynamic matching thresholds for different types of signatures, such as printed names, stylized marks or multi-signatory accounts, depending on the associated risk level. Integration with authorization matrices and transaction rules further supports automated approval of checks within configured limits.

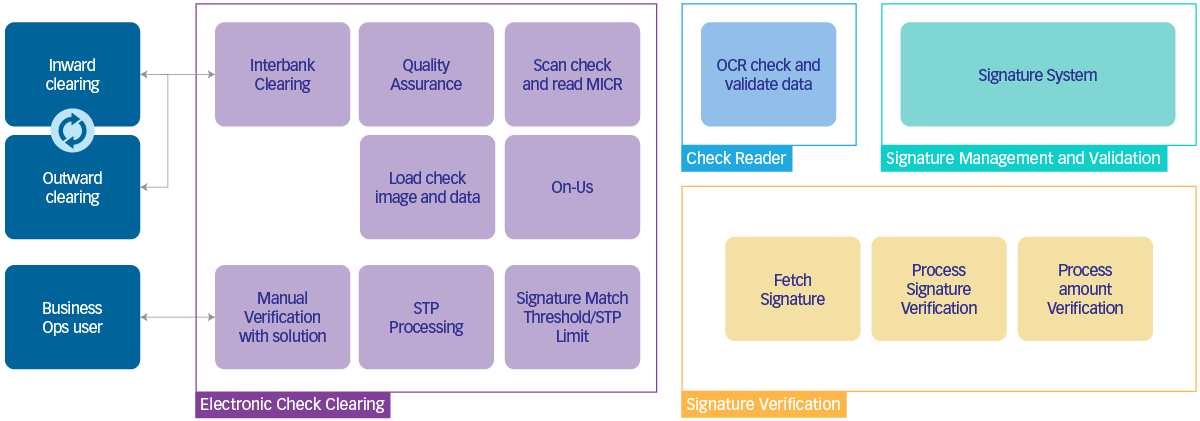

A Look at the Full Automation Workflow

To visualize how these components come together, the following diagram presents an end-to-end design of an automated check clearing process. It includes inward, outward and on-us check workflows, and highlights how data extraction, technical validation, signature processing and system integration all work in sync to support straight-through processing.

Conclusion

In an era of on-demand services, banks seek straight-through processing of checks with minimal human intervention while ensuring compliance with security and regulatory standards. A comprehensive automation solution can significantly enhance operational efficiency, reduce costs and free up human resources for higher-value tasks.

It enables banks to process large volumes of checks by automating key functions like content extraction, signature verification, authorization matrix checks, alteration detection, UV pattern verification and historical pattern analysis. With these capabilities, some banks have successfully automated over 60 percent of check payments, demonstrating the tangible impact of intelligent automation in check clearing operations.