June 30, 2025

Bridging Fragmentation: A Central Bank Imperative

Despite rapid advances in digital innovation, global payment systems remain fragmented creating inefficiencies, limiting financial access and exposing users to fraud risks. A customer traveling internationally, for example, may encounter barriers when making a basic transaction when switching between apps, facing processing delays or incurring unexpected hidden fees. Such recurring challenges reflect a deeper structural issue: fragmented payment infrastructures.

As digital transactions become the financial backbone of modern economies, achieving a seamless payment ecosystem is essential. Yet many markets still face challenges due to payment fragmentation, which results in inefficiencies, higher operational costs and increased risks.

Fragmentation occurs when payment networks, financial institutions and regulatory frameworks operate in isolation, lacking interoperability and coordination. This results in duplicative infrastructure, inconsistent regulatory standards and operational inefficiencies in both domestic and cross-border payments.

This article examines the hidden costs of payment fragmentation, the imperative role of central banks in bridging these divides when driving standardization, and key considerations for designing an integrated, future-ready global payment infrastructure.

The High Cost of Payment Fragmentation

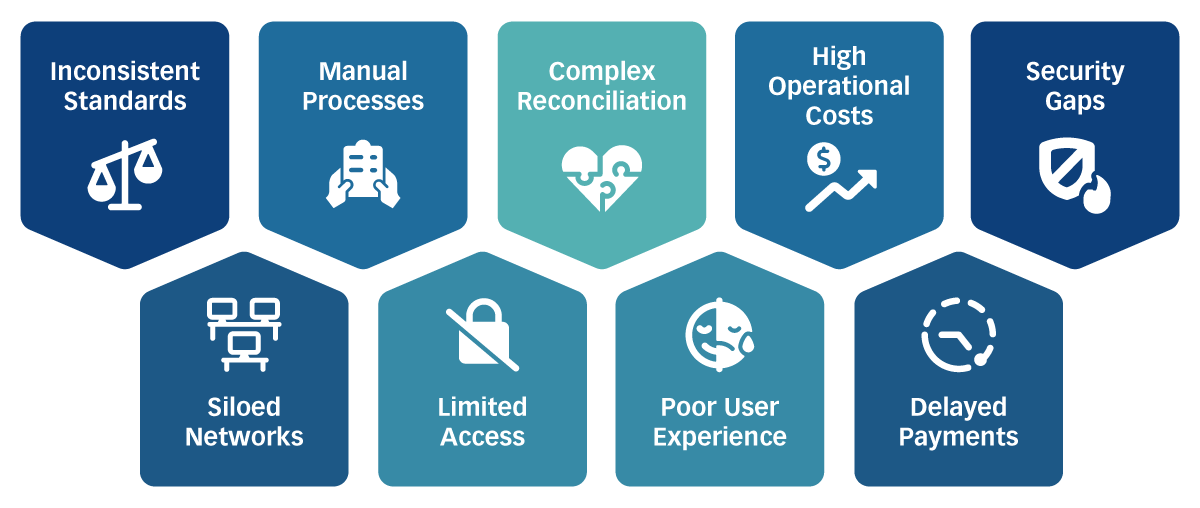

Diagram 1: Payment Fragmentation

A fragmented payment ecosystem results from a lack of interoperability between different payment rails, systems and standards. This fragmentation leads to numerous inefficiencies, including:

1. Increased Operational Costs

For banks, navigating payment fragmentation is like maintaining multiple highways that do not connect. Consider a global retailer operating across Asia, Europe and the Middle East. Each region has different payment processors, regulatory compliance requirements and settlement timelines. Consequently, processing a single cross-border transaction requires integration with multiple intermediaries, significantly raising costs, slowing down settlements, and causing substantial operational burdens. According to McKinsey & Company, “Global Payments 2022: The New Growth Game,”, banks spend up to 15–20% of their payment revenues on compliance and system maintenance alone.

Similarly, merchants accepting digital payments across cards, mobile wallets and bank transfers must process transactions through multiple intermediaries, including payment processors, acquiring banks and settlement networks. Likewise, an e-commerce retailer selling internationally must integrate with different local payment gateways to accept transactions from global customers, further amplifying complexity and costs.

2. Slower Transaction Speeds and Friction for Users

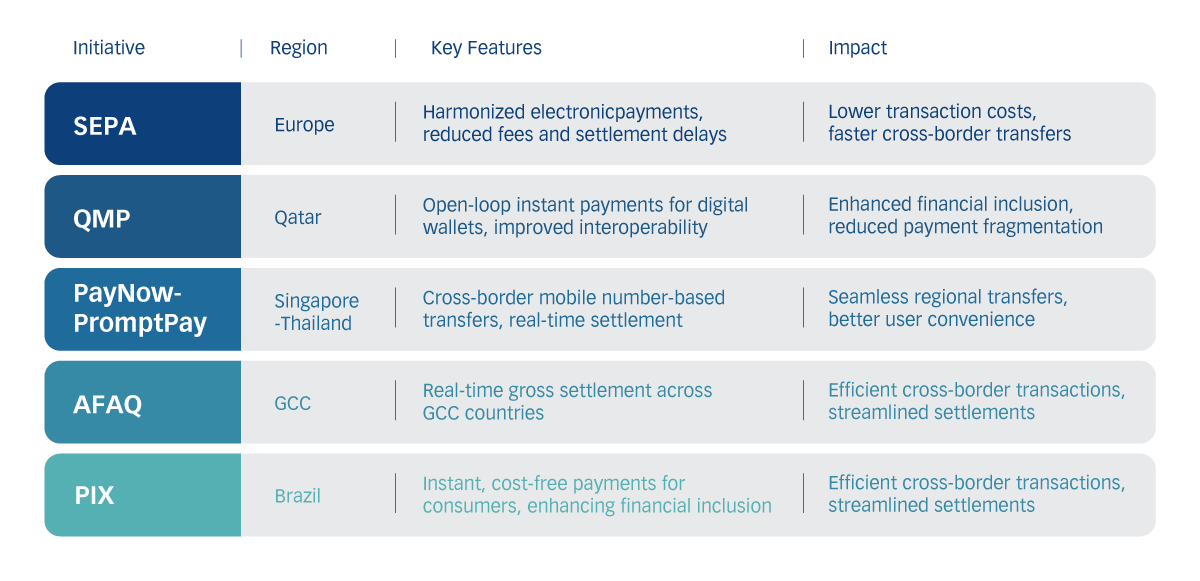

Fragmentation causes delays that frustrate consumers and businesses alike. Imagine waiting days for a basic transaction to clear—purely because different banking networks’ lack of interoperability. Fragmented systems introduce delays in transaction processing due to interoperability challenges between different financial networks. Cross-border transactions, in particular, suffer from prolonged settlement times due to a lack of standardized messaging protocols and reliance on correspondent banking networks. For instance, before the Single Euro Payments Area (SEPA), cross-border euro payments were significantly more expensive and time-consuming due to differences in national clearing systems.

3. Financial Exclusion and Limited Access

Siloed payment infrastructures restrict essential financial services, particularly for underbanked populations. A mobile money service in one country may not be compatible with digital wallets in another, preventing efficient cross-border remittances and hindering broader financial inclusion.

4. Increased Risk of Fraud and Security Breaches

Fragmentation creates security vulnerabilities. Without standardized protocols for authentication, encryption and fraud detection, financial institutions and consumers are more exposed to cyber threats. According to the European Payments Council's “Payment Threats and Fraud Trends Report 2022,”, social engineering attacks and phishing attempts have been increasing, often leading to authorized push payment fraud.

It comes as no surprise that fraudsters look to exploit gaps between legacy banking systems and emerging fintech solutions, leveraging inconsistencies in security measures to commit fraudulent transactions.

Central Banks as Catalysts for Payment Standardization

To mitigate these inefficiencies, central banks play a key role in fostering harmonized and interoperable payment infrastructures. The following strategies can help reduce fragmentation:

1. Facilitating Interoperability and Standardization

Central banks can enforce uniform frameworks to ensure compliance and promote open-loop systems. By mandating the widespread adoption of payment messaging standards (such as ISO 20022), central banks enable seamless data exchange across different financial entities. Furthermore, standardizing compliance frameworks for Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is crucial to enhancing both domestic and cross-border interoperability.

For instance, Qatar Central Bank’s modernization efforts exemplify how central banks can effectively address fragmentation in national payment systems. Initiatives such as the Qatar Automated Clearing House (QATCH), and the Instant Account-to-Account Transfer service (Fawran) have collectively strengthened the interoperability, speed and accessibility of domestic payments. These strategic developments illustrate how central bank leadership can drive national payment infrastructures toward greater integration and resilience.

2. Encouraging Public-Private Collaboration

Achieving an efficient and interconnected payment infrastructure requires active cooperation between central banks, commercial banks, fintech firms and payment service providers. Central banks must align innovation with regulatory oversight to maintain financial stability and integrity. The Monetary Authority of Singapore’s collaboration with banks and fintech firms to launch the Fast and Secure Transfers (FAST) network is a prime example, enabling instant transactions between banks and e-wallets, significantly improving payment efficiency and user experience.

3. Promoting Open-Loop Systems and Cross-Border Integration

Encouraging interoperability across payment networks is critical to reducing fragmentation. Open-loop systems allow banks, fintech firms and mobile money providers to operate under a unified framework.

Additionally, direct linkages between domestic real-time payment systems further reduce friction in cross-border transactions. For instance, the Qatar Mobile Payments (QMP) initiative introduced an open-loop instant payment system for digital wallets, substantially enhancing domestic payment interoperability within Qatar.

Similarly, the link between Singapore’s PayNow and Thailand’s PromptPay allows individuals to transfer money across countries instantly, conveniently and securely. Simply done by using only their mobile numbers which ultimately reduces barriers to cross-border payments.

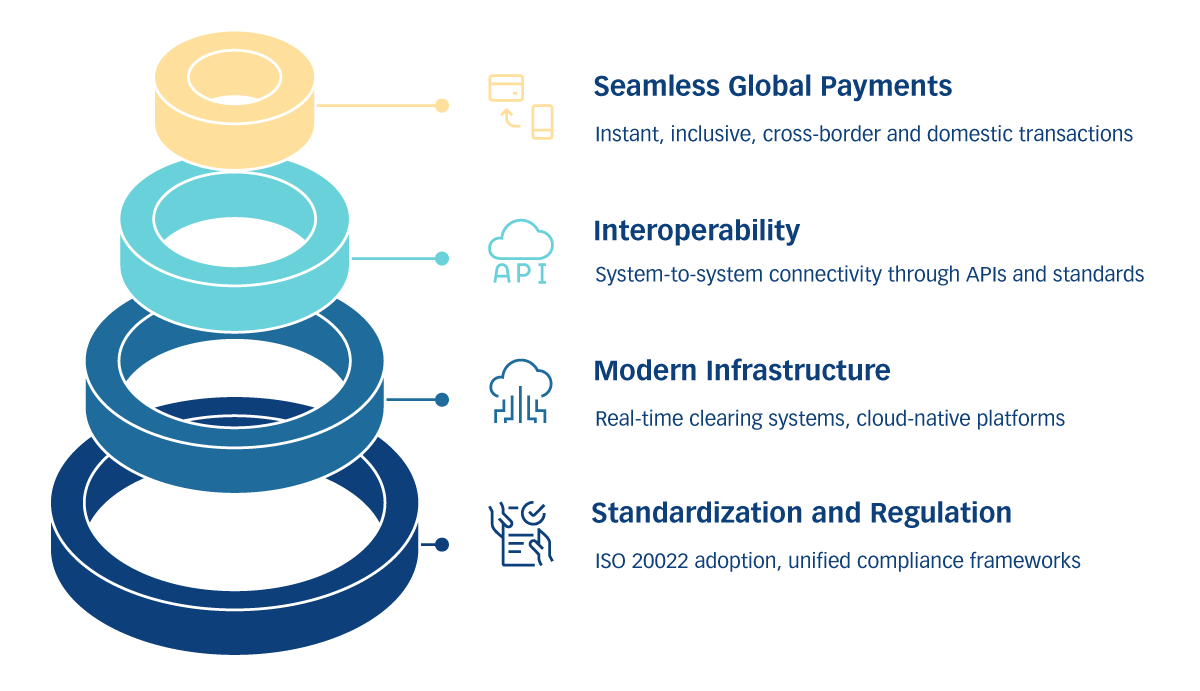

Foundations of a Standardized Global Payment System

The following diagram outlines the key components enabling seamless global payments, from Standardization and Regulation at the base to Seamless Global Payments at the top, with a focus on Modern Infrastructure and Interoperability in between.

Diagram 2: Foundations of a Standardized Global Payment System

Global Initiatives in Payment Standardization

The following table summarizes key initiatives in payment standardization across different regions, highlighting their features and impact on financial ecosystems:

Table: Key Global Initiatives Driving Payment Standardization

Payment Standardization Design Principles

To build a harmonized and efficient payment ecosystem, central banks and policymakers should prioritize the following key design principles:

1. Adoption of Unified Standards

To eliminate fragmentation, financial institutions and central banks must adopt globally recognized payment messaging and settlement standards. Open Application Programming Interfaces (APIs), widely embraced standards such as ISO 20022 and cloud-based payment infrastructure enable smooth integration, reducing reliance on legacy systems and facilitating interoperability across different financial entities.

2. Enhancing Cross-Border Payment Mechanisms

Linking domestic real-time payment systems with regional and global frameworks can substantially reduce delays and accelerates economic integration. Central banks can collaborate on regional initiatives to establish direct corridors between countries.

For example, The Bank for International Settlement’s Project Nexus aims to connect instant payment systems across the Association of Southeast Asian Nations (ASEAN) countries, promoting real-time cross-border transactions. Whereas the Gulf Cooperation Council’s AFAQ, enables real-time gross settlement across GCC countries for seamless cross-border transactions between Gulf states.

3. Prioritizing Security and Compliance

With standardization comes a critical need for robust security measures. Central banks must enforce strong cybersecurity frameworks and regulatory compliance requirements to mitigate risks while ensuring seamless payment integration. For instance, the introduction of Strong Customer Authentication (SCA) in Europe is an example of how security can be enhanced while maintaining smooth transaction flows, reducing online payment fraud.

4. Ensuring Cost Efficiency and Accessibility

When central banks establish fair pricing structures, a broad participation from financial institutions of different sizes can participate actively in the payment ecosystem. Brazil’s PIX system is an optimal example, offering instant payments at no cost to consumers and encouraging widespread adoption and inclusivity.

As global economies become increasingly interconnected, advancing payment standardization is no longer optional, it has become essential for ensuring sustainable financial inclusion and economic resilience.

Conclusion

A fragmented payment ecosystem carries hidden costs, from operational inefficiencies and financial exclusion to heightened security risks. Central banks are uniquely positioned and responsible for leading the transformation toward greater interoperability, unified standards and inclusive infrastructure. By fostering collaboration across the financial ecosystem, they can pave the way for a more resilient and connected payments landscape—both domestically and globally.

The transition from fragmented payment systems to seamless interoperability doesn’t just streamline transactions; it enhances economic inclusion, consumer experience and market resilience. Emerging innovations, such as blockchain-based settlements, Central Bank Digital Currencies (CBDCs) and AI-driven compliance, promise further acceleration toward global payment interoperability.

The question remains: will central banks take the lead in shaping a seamless, resilient and inclusive global payment ecosystem?