January 16, 2022

5 Elements of Equally Usable and Secure Solutions

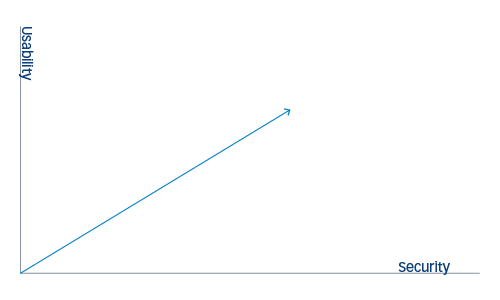

Historically, reliable security has often come at the price of usability, and vice versa. Today, many still believe that there is no possibility to offer adequate security and usability simultaneously at no compromise, in which they assume that a secure solution should be ‘complicated’ while a usable solution should be ‘easy to use’.

However, since companies and their staff require effective solutions that do not hinder performance, usable solutions have long been preceding secure ones for the purpose of maintaining efficient workflows and competent functioning, resulting in the use of unsustainable and unsecure solutions.

Security is essential at all levels

Security is now more essential than ever for most companies. Data protection requirements such as the GDPR, additional legislation, and best performance ensure that safety is integrated into the operations and culture of companies. Design security is recommended.

With increasing cyber hazards and the evolution of information protection rules, the exposure of sensitive organizational data has also become within reach; a vulnerability that companies must safeguard to maintain their business, reputation and figures.

Among those companies are fintechs who are required to implement robust safety procedures and technologies to ensure that they are processing data safely, even at the price of usability. But how can they thrive when their customer base expects user-friendly experiences?

The answer is simple. New efforts are required to attain both usable and secure solutions that meet organizational objectives and market demands simultaneously.

Fortunately, modern solutions offer effective security measures with an enhanced user experience.

How modern technologies can cover usability and security

A common example of high usability but low security is the automatic ‘remember me’ feature in websites, especially in any financial-related websites such as online banking. This feature is extremely friendly for users as they only have to enter their username and password once, and it will automatically be saved for future use. However, if the same device is used by several people, the feature is extremely unsecure.

Today however, system designers and product owners must always keep in mind the relationship between usability and security.

While keeping this in mind, modern technologies can offer both usable and secure solutions by combining the following 5 requirements:

-

Secure by default and design

Security and usability cannot be added as soon as the technology has been established but should be an essential part of the product design procedure from the beginning. They should also cover the entire aspects of the solution from design to end users which may involve design, expansion, conformation and maintenance.

This in turn results in secure solutions by default and design, which ultimately furnish usable solutions, in which everything is planned according to inhibiting harmful actions, while ensuring that they are easy to complete.

-

Inherent security measures

Users are often drawn to flexible controls and functionalities, with minimal efforts that do not hinder their everyday responsibilities. As there are always several methods to complete the same action, the optimal scenario is inherent security that does not demand dramatic operational functions to accomplish.

-

Friendly interface

It is vital to ensure that any interface is straightforward and requires minimal thinking to navigate. If there are choices for the users, the harmless selections should be fortified by making them the default or normal course.

-

Practical security

Security should be realistic and practical keeping in mind the actual users who make mistakes in applications and circumstances. Accordingly, practical security is essential to be built around real-life circumstances through covering every possible scenario, in its detail, and then offering the users with the right advice when they need it.

-

Consideration of processes

Solutions that fit jobs and situations appropriately are crucial. As several goods exist to ensure safety, different ways of fulfilling duties exist as not all solutions are suitable for all circumstances, but that is OK. Ensure that the items used to do each activity provide the highest possible safety. If necessary, layer solutions without adding difficulty. Maintaining simple security will favor more outstanding outcomes.

Closing thoughts

Safety and usability should not be regarded as trade-offs – if a solution is not usable, good safety is worthless, and vice versa. We need to ensure that solution stakeholders work together to ensure both secure and functional experiences.

Fortunately, with machine learning and artificial intelligence technologies, enhancing security measures will not disrupt seamless user experiences.