July 20, 2025

From Promise to Practice: Realizing the Value of AI In Payments

Artificial Intelligence (AI) is poised to transform financial services, set to amplify customer engagement, streamline operations, and tighten compliance. If banks fully tap into its potential, AI could unlock serious revenue streams. When approached strategically, this technology serves as a catalyst for lasting competitive advantage.

Yet, AI’s transformative potential depends entirely on high-quality, accessible data. In an industry where precision and accuracy are crucial, subpar data can jeopardize success, hinder efficiency, and cap potential revenue growth. Poor data quality undermines the ability to fully capitalize on AI’s benefits.

Where Do Banks Face Hurdles?

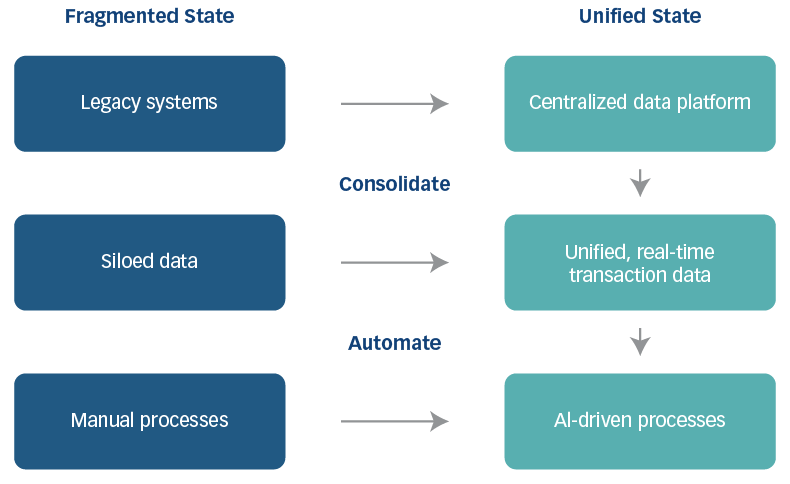

Fragmented payment and transaction data, trapped in legacy systems and siloed infrastructure, complicates AI implementation. This scattered data blocks the path to robust AI models, risking incomplete or shaky insights that could stall strategic goals.

Outdated systems and lack of coordination exacerbate these barriers, delaying progress. By breaking down these barriers and unifying data, banks can fuel AI’s potential and turn obstacles into opportunities for growth.

The shift from fragmentation to AI enablement looks like this:

And the Solution?

Setting up modern data platforms is critical to unlocking AI’s promise. These systems streamline financial data by centralizing, organizing, and routing it with precision, wiping out silos and ensuring rock-solid consistency. They enable real-time access, seamless system integration, and ironclad compliance with regulations, setting the stage for AI to deliver powerful, revenue-driving results. This enables smarter decision-making and accelerated innovation to maintain market leadership.

It’s a tough journey. Banks must commit serious resources to identify data sources, verify data quality, and tackle integration hurdles. But this challenge is far from impossible.

With disciplined focus, even large institutions can transform their random, disorganized transaction data into a strategic asset.

The Start Small, Scale Smart Approach

To avoid being overwhelmed, banks should kick off with targeted, high-yield data projects. By zeroing in on high-impact areas such as fraud detection and customer analytics, while leveraging modern, AI-driven platforms, they can secure early wins and build momentum. These quick hits prove the value of AI, rallying support for bigger moves.

These initial successes create a strong data foundation, powering advanced initiatives like proactive transaction interceptions, optimized transaction routing, predictive cash flow analysis, and other advanced topics.

Leveraging External Expertise

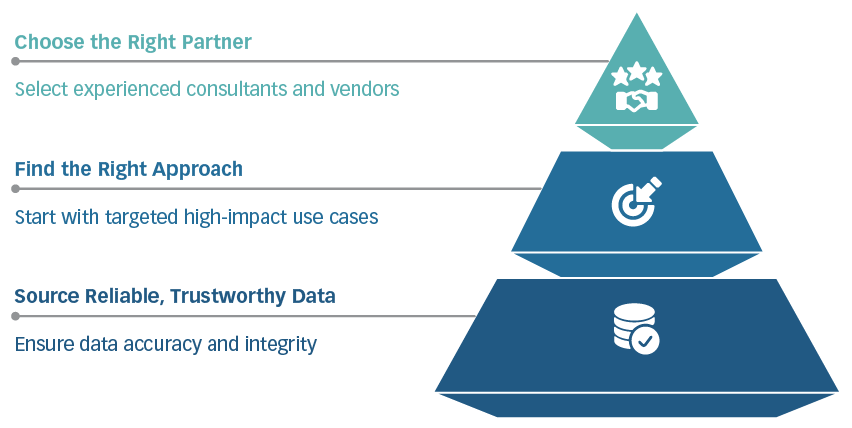

A successful AI journey in banking rests on three critical pillars:

To accelerate this journey, banks should bring onboard external expertise such as seasoned consultants and visionary vendors who offer proven knowledge and modern solutions. These partners can fast-track data unification by mapping chaotic systems, automating data enrichment and quality checks, and deploying AI-driven platforms tailored to banking needs.

For example, consultants can streamline legacy system integration, while pre-built vendor solutions for fraud detection or predictive analytics can greatly reduce setup time. This collaboration not only accelerates early wins but also equips banks with best practices to scale smartly, turning data complexity into a competitive edge.

Conclusion: Seizing the AI Advantage

By committing to ongoing optimization, continuously refining data platforms and processes, they can stay ahead of the curve. This isn’t a one-and-done fix; it’s a commitment to evolving with the industry.

This relentless focus transforms data into a strategic weapon, unlocking AI’s full potential to drive consistent growth.