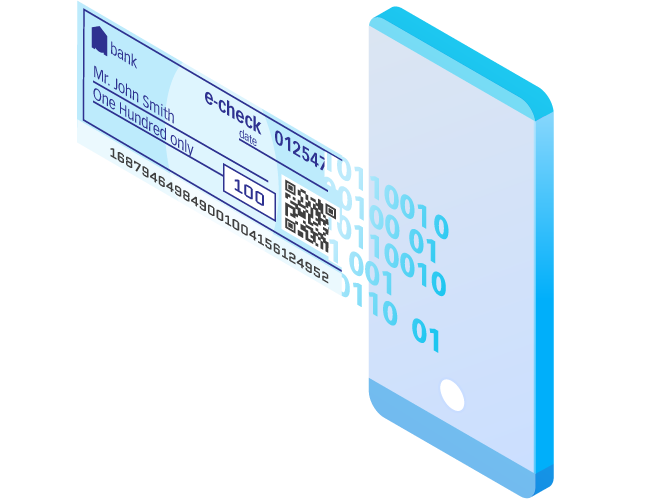

Mobile Electronic Check Issuance

ProgressSoft’s Mobile Electronic Check Issuance Suite transforms the check lifecycle into a secure, cryptographic environment. Comprising both central and participant components, it manages the entire e-check process from issuance to clearing, integrating with existing methods while ensuring compliance with international standards.