March 30, 2023

CBDCs: Where in the World Are We At?

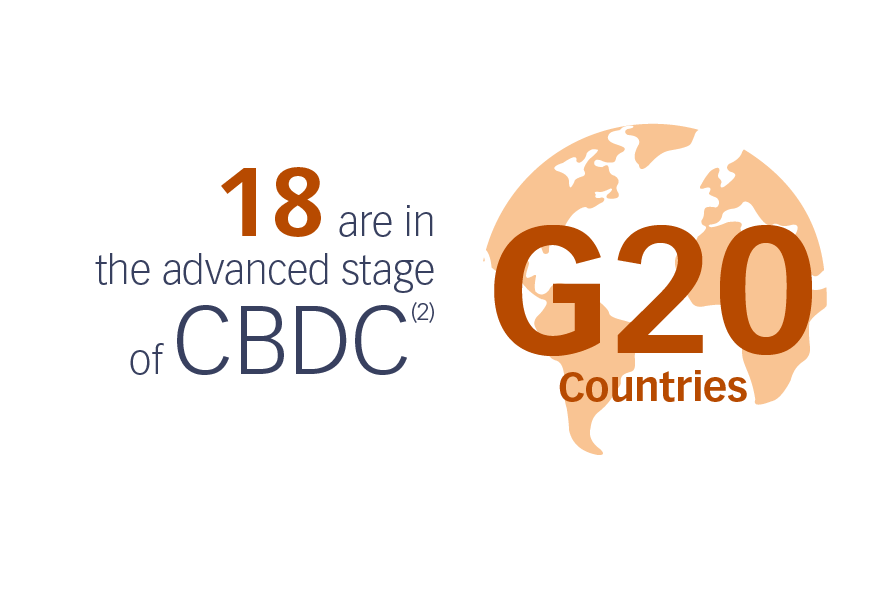

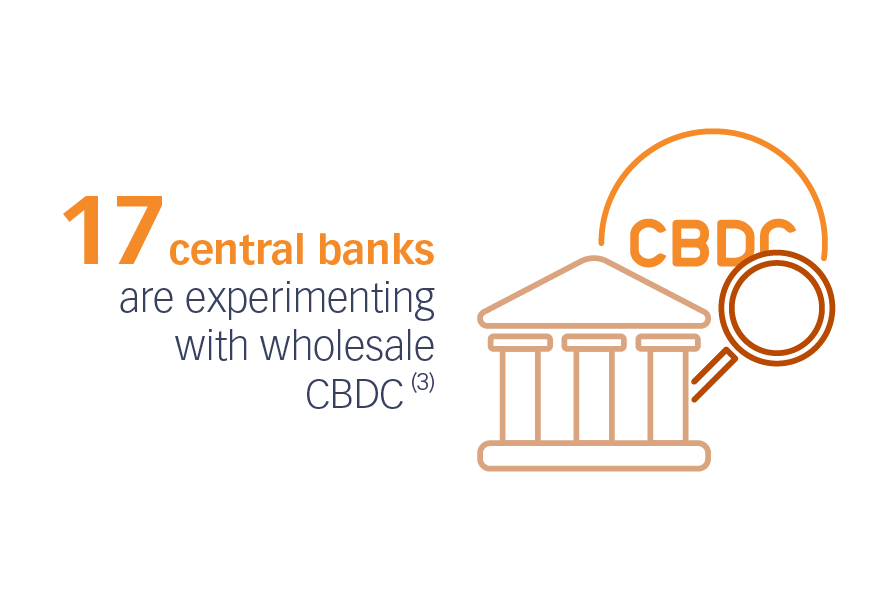

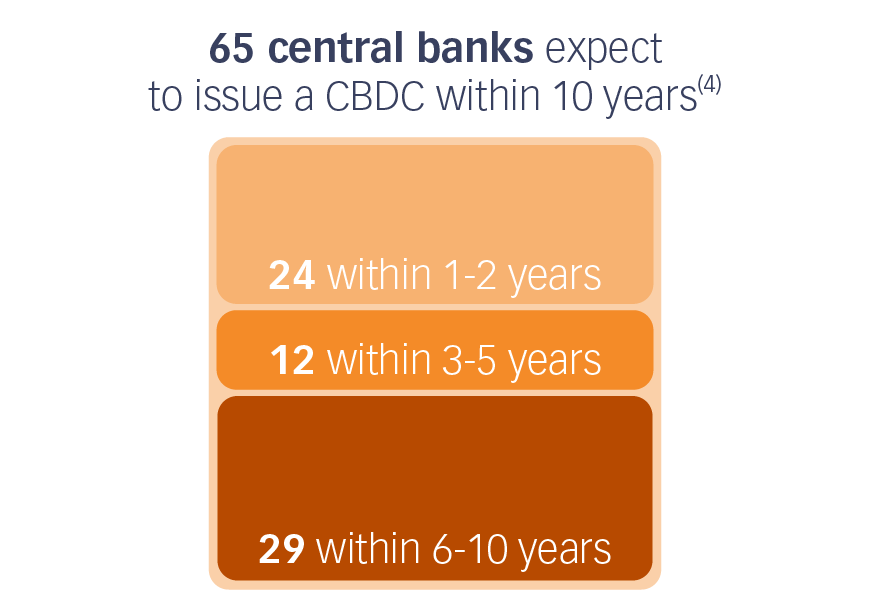

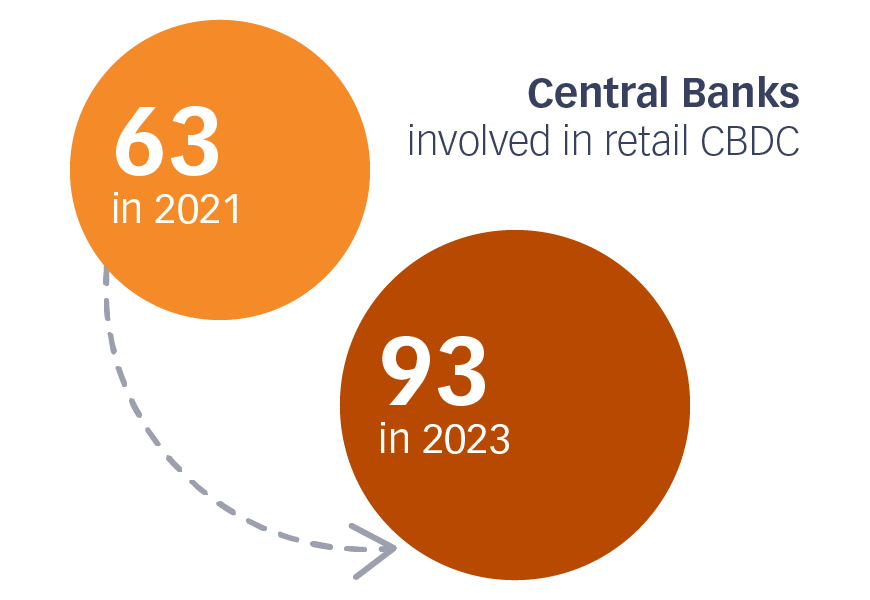

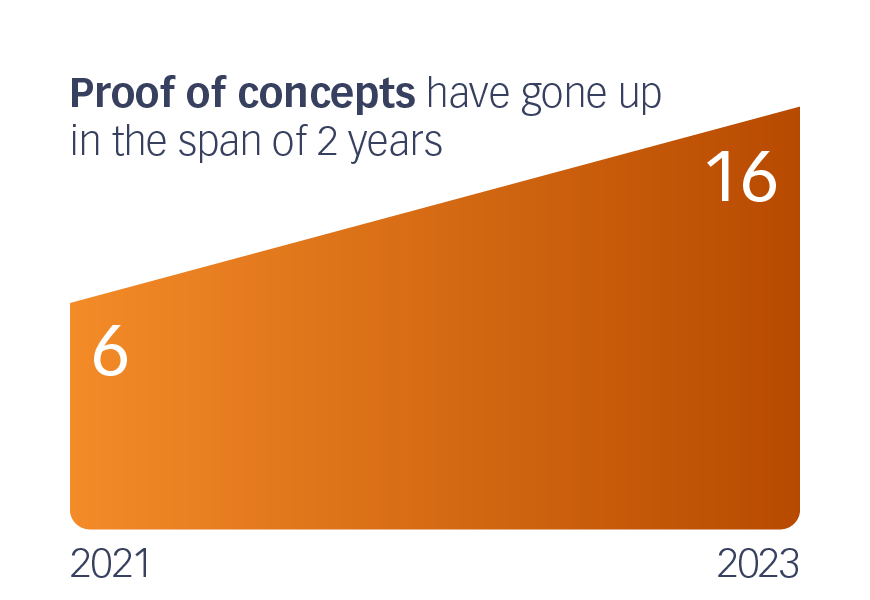

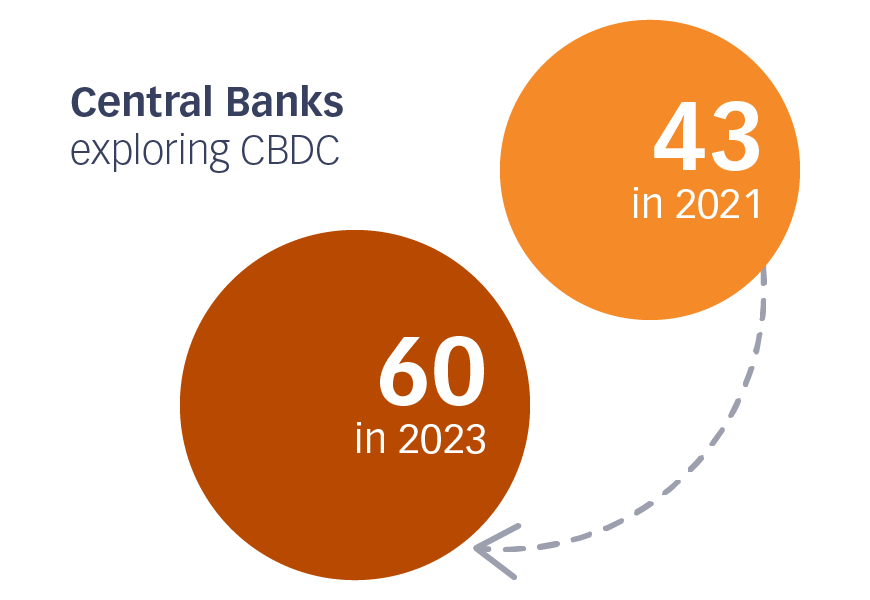

In recent years, we witnessed central banks becoming more and more interested in CBDC to revolutionize their payment ecosystem and effectively satisfy the increasing demand for electronic payments. But where do they stand today, and where in the world are we at with CBDC?

Let’s look at the latest scoop.

Launched Projects