December 10, 2023

Regulatory Strategies for a Resilient Instant Payment Landscape

The pace of evolution in instant payments, also known as real-time or fast payments, has been phenomenal, especially in emerging economies, and has acted as a catalyst to kickstart economic activities. Regulators and governments worldwide are striving to unlock economic growth potential through digital transformation, aiming for efficient and cost-effective instant payment systems. Globally, about 70 plus countries have already introduced instant payment networks, while approximately 125 countries are either in the process of implementing them or have yet to do so. [1]

Through assessment of different global implementations, we can observe numerous outcomes resulting from the adoption of instant payments in these countries. These outcomes are innovation introduced by corporates, startups, and policymakers, as well as valuable data insights and intelligence. Additionally, this adoption broadens avenues for tax collection, minimizes cash handling difficulties and associated costs, and unlocks new opportunities for banking services.

Here are some key pointers or highlights we can gather from observing global implementations of instant payments:

- Facilitating frictionless enrolment, seamless payment processing, and interoperability are critical success factors for regulators/payment system operators.

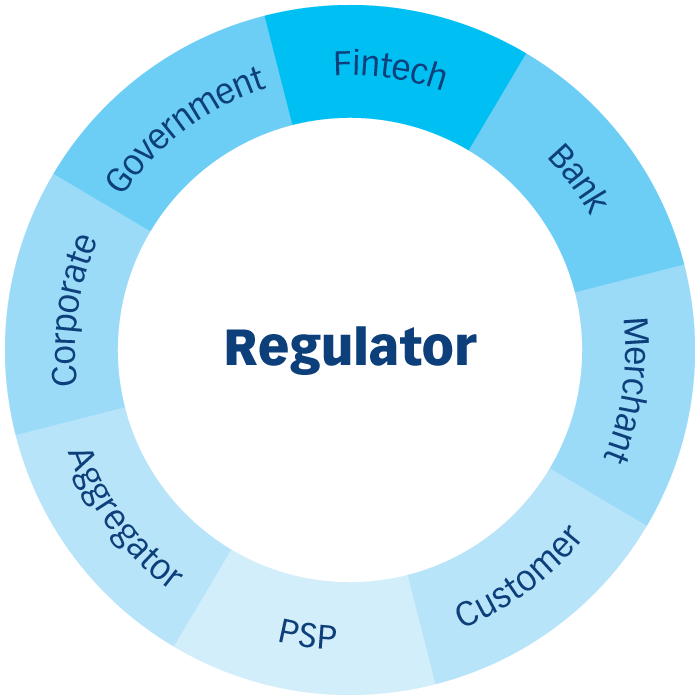

- Regulators and payment system operators establish an ecosystem that incorporates banks, wallet providers, fintech firms, and payment service providers to harness their respective strengths and ensure the system's robustness and success.

- Regulators view instant payment systems as essential alternate payment rails that support business continuity and mitigate economic risks stemming from geopolitical factors.

- Consumers show a preference for digital and mobile-first payment experiences, utilizing instant payments.

- Instant payment rails have made person-to-business payments more cost-effective and faster when compared to traditional card-based systems.

- While person-to-person payments constitute the larger share of instant payment volumes, instant payments are particularly suitable for driving innovation in business-to-customer and business-to-business segments due to their flexible payment orchestration capabilities.

- The switch from cash payments to digital payments accounts for a large share of instant payment volumes in emerging economies.

- Instant payment systems are viewed as market disruptors. Therefore, established players with significant market share may have no monetary incentive to pursue such innovations.

Regulators should assess the factors that influence the level of instant payment usage in the country, they also need to determine how to successfully introduce instant payments as an alternative payment system that fosters business continuity and aligns with the nation's objectives.

As a start, there are an infinite number of use cases that banks, financial institutions, and fintechs can implement on an instant payments system. Such use cases can be implemented in a cost-effective manner, with complete flexibility over the payment orchestration and service delivery:

The regulator's choice of which use cases to introduce, and how they do so, becomes crucial in promoting effective policy implementation and achieving success.

We observe that a varied degree of the regulator’s involvement can yield different results. For instance, the popular Unified Payments Interface (UPI) in India is rolled out by the National Payments Corporation of India (NPCI), an entity owned by banks and regulated by the Reserve Bank of India (RBI). NPCI and RBI have consistently encouraged innovation. Moreover, RBI has directed waiving of the payment charges to individuals and businesses on the UPI network and the federal government is giving annual subsidies to compensate banks for revenue losses. This has led to mass adoption of UPI in the country, with upwards of ten billion payments [2] processed every month.

Similarly, in Oman, the Central Bank of Oman (CBO), the financial regulator, has introduced an instant payment system in the country and has actively encouraged banks and payment service providers to integrate and promote this platform. The CBO has also implemented a balanced and cost-effective charging policy for the system, incentivizing the public to embrace this platform. As a result, the country has witnessed remarkable growth in instant payment volumes over the last few years.

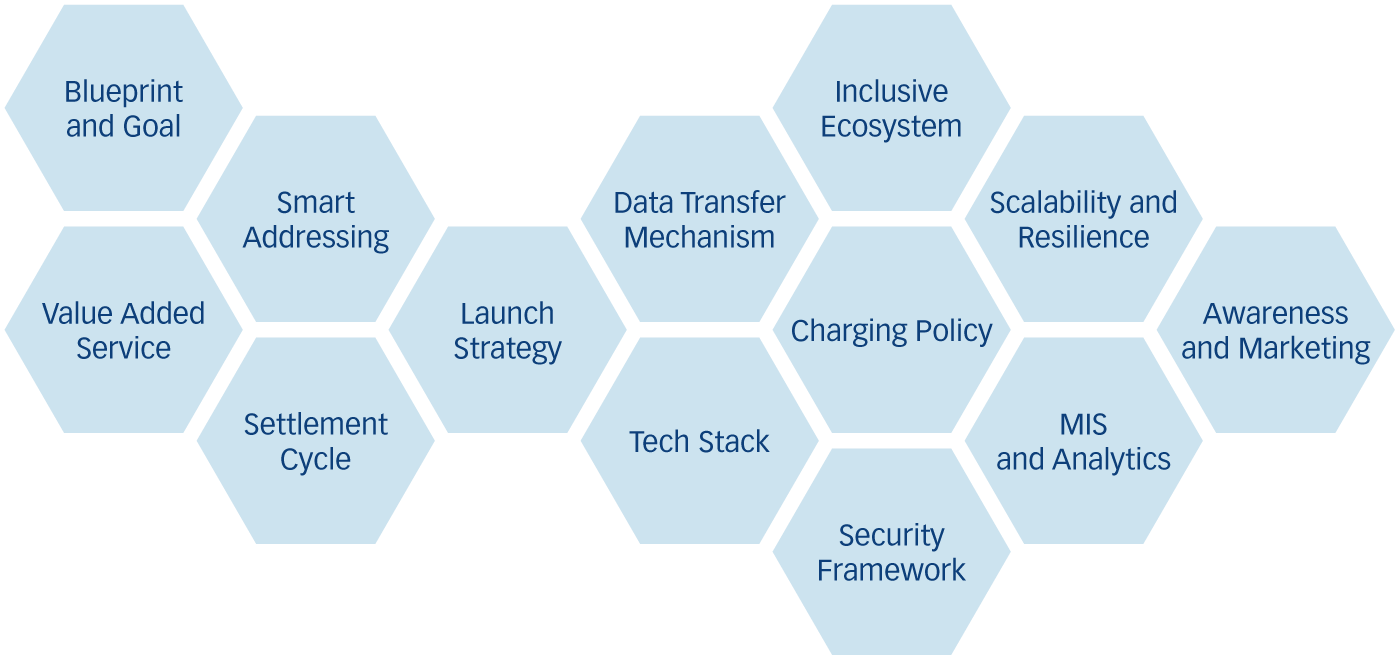

Irrespective of the path and use cases chosen by the regulator, there are critical policy decisions and factors to be considered. These include:

- Audacious goal and blueprint

The regulator needs to have a profound conviction to implement a digital public infrastructure for the public good, underpinned by an audacious goal and blueprint for the country. Building such a platform requires collaborative efforts from all stakeholders to implement the appropriate system with the right policies in place. - Inclusive and unified ecosystem

Creating an inclusive and unified ecosystem leveraging the strengths of all stakeholders including banks, merchants, payment service providers, etc. is key to the success of instant payments in the country.

- Secure and dynamic architecture

Establishing a resilient and secure system architecture that is flexible and agile, while also capable of supporting innovation incrementally. - Data transfer mechanisms

A key necessity for the interoperability of the instant payments system is having a unified QR code specification, as well as other data transfer mechanisms like Near Field Communication (NFC). - Settlement mechanism

Defining a settlement mechanism that will enable the system to operate on a 24x7 basis, while ensuring the settlement risk is effectively addressed. - Scalable tech stack

Selecting a technology stack that is scalable and resilient to support growing business and capacity demands is very crucial for a sustainable instant payments network. - Charging policy

The regulator should establish a well-balanced payment charging policy that is affordable for both consumers and businesses, while remaining sustainable for stakeholders, to foster ongoing innovation. - Addressing methods

The smart addressing system chosen should have more than one addressing method like mobile number, alphanumeric address, and other national identification numbers, this will have a long-term benefit in building new use cases on the instant payment network. - PSPs and fintechs

Payment Service Providers (PSPs) and fintechs can play an important role in bringing innovation into the payment space, hence the viability of separating account-holding institutions from Payment Initiation Service Providers (PISPs) should be explored. - Management Information Systems (MIS) and analytics

MIS and analytics are essential for measuring and monitoring platform performance and this will be an important input for facilitating the development of future innovations. - Launch strategy

Regulators must create a launch strategy for the system, involving all key stakeholders in the initial launch, and provide a time-bound roadmap for the rollout of additional features and services. - Awareness program

Since this will be a new payment system, branding, effective marketing, and running an awareness program is a necessary task that needs investment and attention from the regulator and stakeholders. This is very essential for uniform messaging and encouraging mass adaption.

Conclusion

An effective policy decision is imperative for achieving sustainable success in instant payment initiatives. In addition, collaborating with payment solution providers and studying the experiences of other countries with similar use cases can offer invaluable insights into what works and what does not. By combining these strategies, regulators and stakeholders can pave the way for a robust instant payment ecosystem using the below summarized guidelines:

- Develop a comprehensive blueprint for instant payment rails, clearly defining the intended use cases for implementation.

- Identify the key stakeholders who will be part of the ecosystem and actively promote collaboration between the public and private sectors.

- Procure a technology and solution stack that not only meets current needs but also offers flexibility to accommodate future requirements and changing market dynamics.

- Establish Standard Operating Procedures (SOPs) with a pricing policy and formulate a well-defined launch strategy.