February 10, 2023

Are Digital Banking Solutions Profitable for Banks?

The global pandemic has accelerated demand for digitization in the banking industry, and digital banking platforms are now taking center stage.

Let us demonstrate the potential opportunities that banks can grasp with digital banking solutions as well as the future trends toward digitization in the banking sector.

Trends

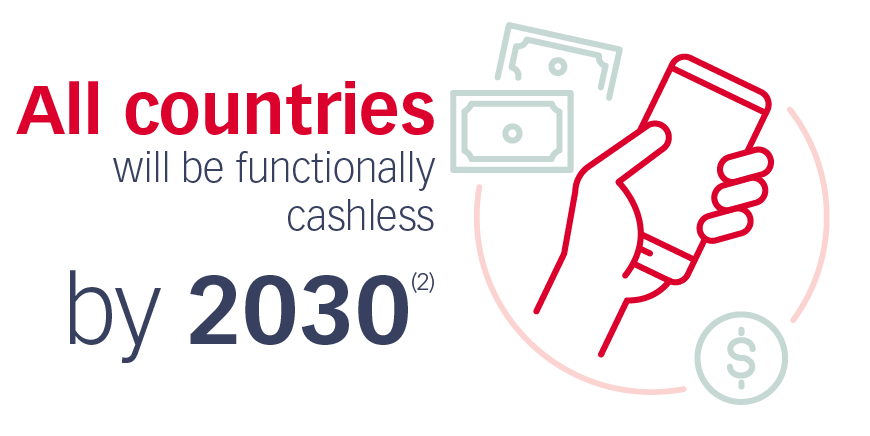

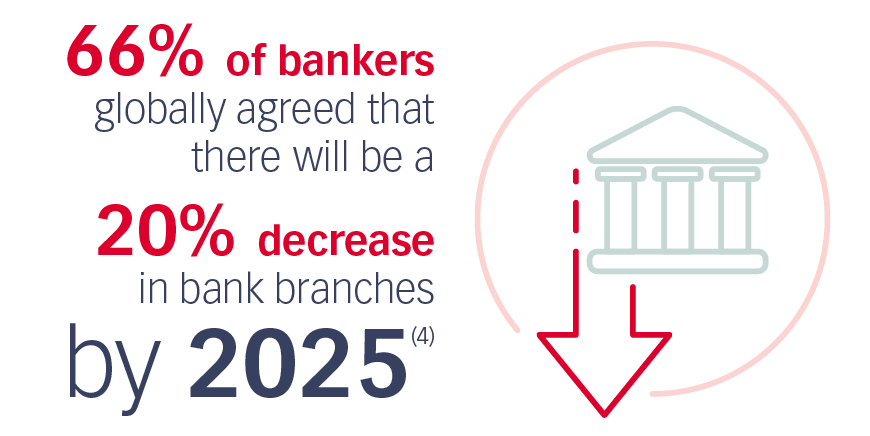

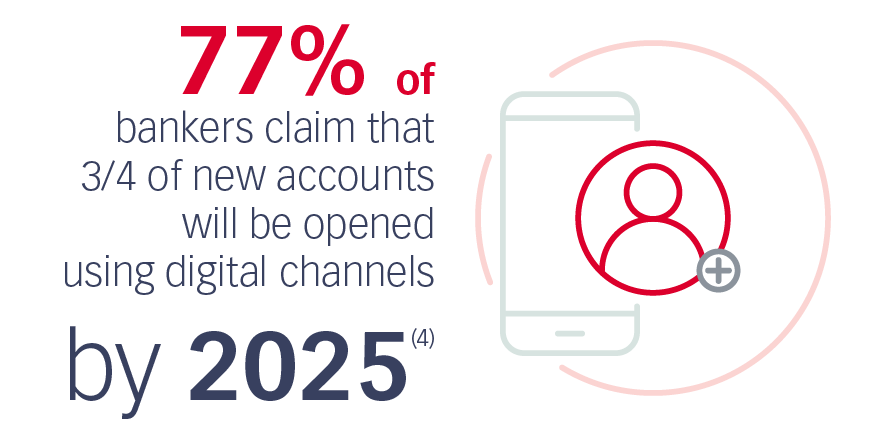

The introduction of new technologies and migration to a cashless society creates a favorable future for digital banking solutions for end-users and financial institutions.

The top 3 retail banking trends(5) for 2023 that can be facilitated by a digital banking solution are:

Opportunities

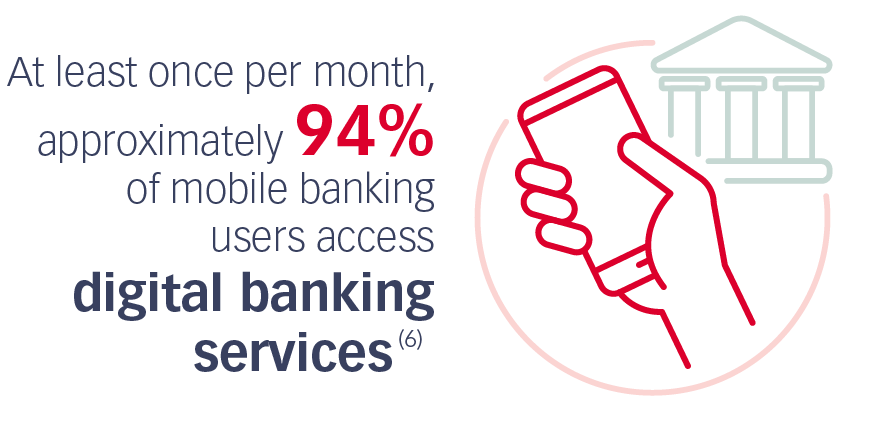

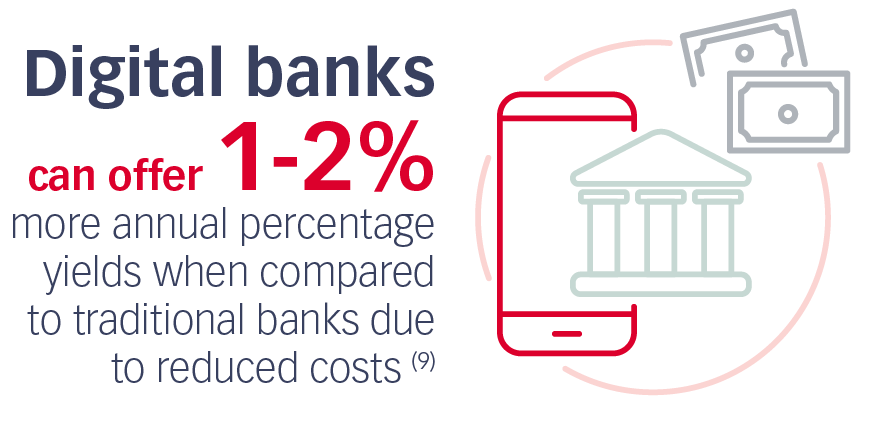

A digital banking platform offers great potential for banks to smoothen their operations, reduce costs and increase revenue streams.

References

- https://www.bloomberg.com/press-releases/2022-09-19/digital-payment-market-to-hit-opportunities-worth-361-30-billion-by-2030-grand-view-research-inc

- https://www.globaldata.com/media/thematic-research/banking-will-centered-around-smartphone-2030-countries-become-functionally-cashless-says-globaldata

- https://www.juniperresearch.com/press/digital-banking-users-to-exceed-3-6-billion

- https://thefinancialbrand.com/news/banking-branch-transformation/bank-branches-omnichannel-digital-delivery-trends-132770

- https://thefinancialbrand.com/news/banking-trends-strategies/top-10-retail-banking-trends-and-priorities-predictions-2023-157672

- https://www.enterpriseappstoday.com/stats/digital-banking-statistics.html

- https://www.juniperresearch.com/press/bank-cost-savings-via-chatbots-reach-7-3bn-2023

- https://www.consumeraffairs.com/news/online-banking-has-become-more-widespread-among-consumers-survey-finds-103119.html

- https://www.investopedia.com/articles/pf/11/benefits-and-drawbacks-of-internet-banks.asp