May 30, 2022

Why Invest in Instant Payments?

The globe is now headed towards instant payments due to the great benefits that they provide. Instant payments, also referred to as retail payments, faster payments, or immediate payments, enable money to be sent, cleared and settled within seconds.

Not only do instant payments promote financial inclusion, but they also help financial institutions mitigate risks and illegal activities, and with a prediction of massive growth rates in the next 5 years, let’s find out why banks should engage in instant payments.

of SMEs fail due to poor cashflows (1)

of businesses are willing to pay a fee to receive money instantly (1)

instant payments growth from 2021 to 2026 (2)

of B2B and consumer payments will be instant in 2026 (2)

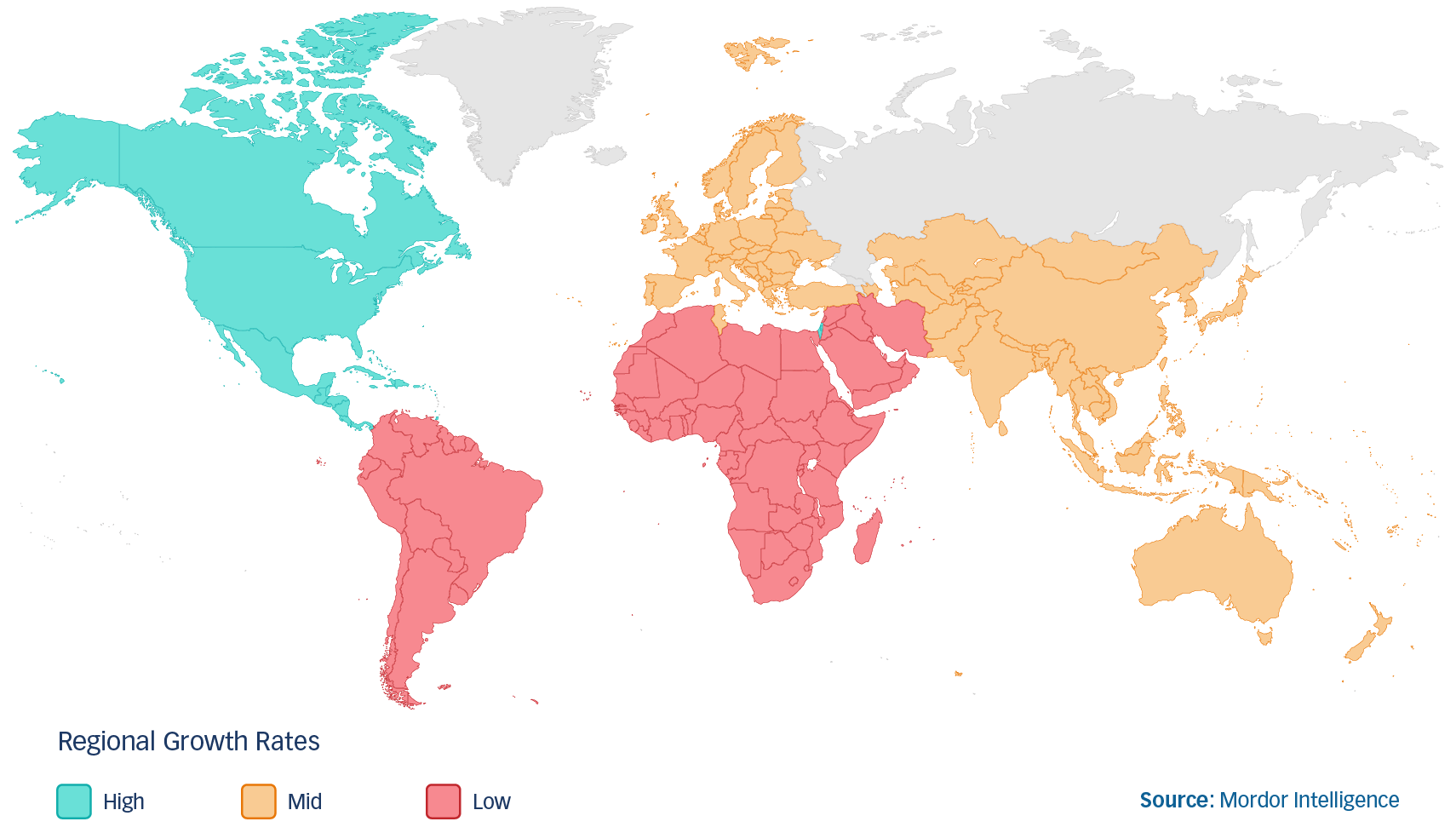

Instant Payments Market Growth by Region (3)

Instant payments operate on

Instant payment transactions are completed within

Instant payments support all types of transactions such as